Gold and silver, the main – but not the only – precious metals for investment, are called safe-haven assets because of situations such as the one they experienced at the end of 2023. The gold metal, without going any further, closed the last quarter with rises of 10.2%, when the conflict in the Middle East intensified, reaching record highs: 2,153 dollars per ounce. The outlook for gold in 2024 is equally optimistic, given that these situations will intensify and there are others that have put the international market on alert.

A safe haven security is one that, in periods of instability or uncertainty, has the potential not only to be maintained but also to increase in value, offering greater protection against the volatility and risks that the market offers.

And the year has not started in the best possible way: attacks are taking place in the Red Sea that have forced many commercial shipping companies to change their routes, raising rates by 70%. To this we should add another possible rate cut by the FED and the increase in the purchase of gold by the Central Banks, a situation that leaves gold as one of the main guarantees at present.

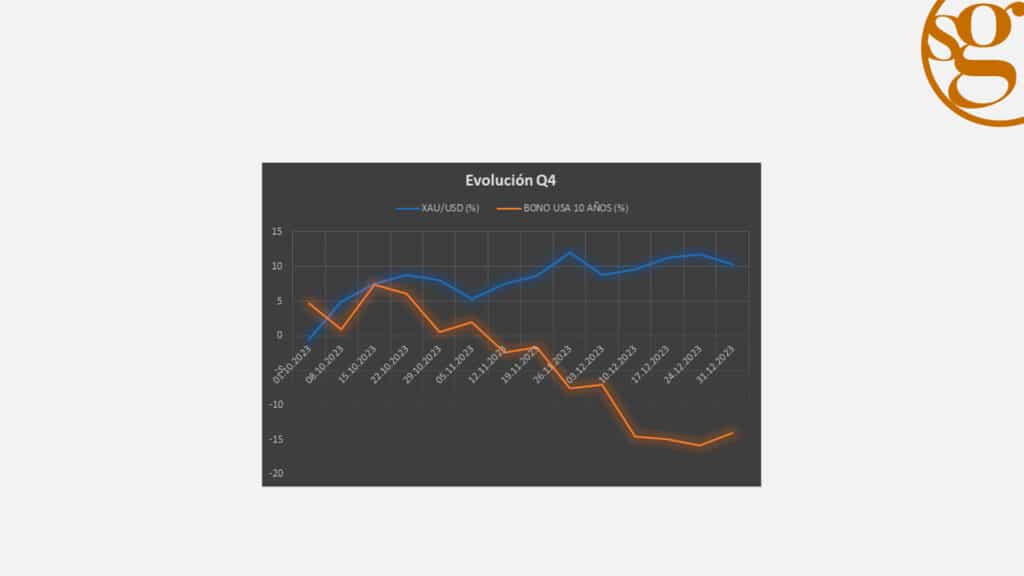

In this comparative chart for the fourth quarter of 2023 we see a clear example of this situation: the 10-year US Treasury bond.

The weakness of the dollar has caused investors of all profiles to focus their attention primarily on gold, whose safe-haven value has intensified in recent months.

Gold’s rally in 2024

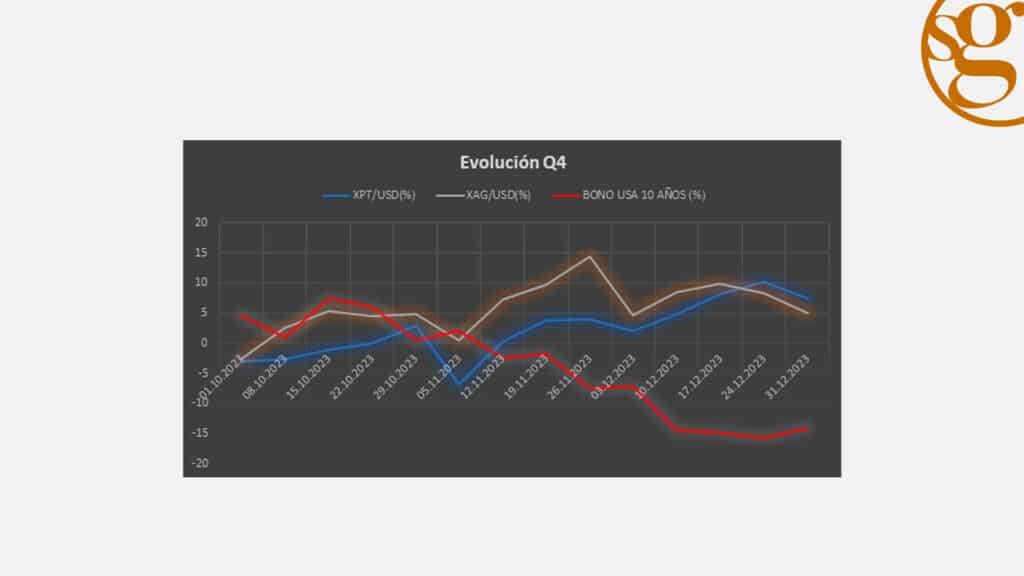

No precious metal has shone as brightly as gold in the past year. Silver, which is in high industrial demand, rose last quarter by almost 5% thanks to a rise in the manufacturing PMI in China, the metal’s main buyer. Platinum did not have a very good 2023, but by the end of the year it had accumulated gains of 7.5%, showing signs of recovery.

Following the previous chart, this one shows the same comparison between silver, platinum and US Treasury Bonds, with ‘XPT’ for platinum and ‘XAG’ for silver.

At first glance, gold’s growth has been much more pronounced and steady. Precious metals expert at Jupiter AM Ned Naylor-Leyland told Cinco Días that gold has become one of the main risk-free assets. There is no crystal ball that can help us anticipate what will happen in 2024, but it is true that the World Bank’s outlook for global growth is quite pessimistic, with a slowdown this year of 2.4% and 2.7% in 2025.

Against this backdrop, with inflation still high and the weakness of the world’s main currencies, precious metals, especially gold, will continue to be one of the main hedging strategies against inflation. The central banks of Brazil, India, Russia, China and South Africa have increased the pace of gold purchases and their reserves are already very similar to those of the United States, a strategy that they will surely repeat and that could further increase the metal’s value.

In fact, according to a Bank of America report, which has dismissed the correlation between war conflicts and the price of precious metals, gold could reach 2,400 dollars in 2024 if the war between Hamas and Israel escalates even further.

Uncertainty seems to have settled in our lives. The fear of the worsening economic situation has spread among the population, overwhelmed by the possibility of losing their savings, the fruit of so many years of work. At SilverGold Patrimonio we help you to access the precious metals investment market in a simple way. Our consultants will study your case to give you the best solutions according to your budget, your objectives and your profile, build your smart wealth and join the precious metals investment wave!